The Single Strategy To Use For Neutralizing Pet Odors

The Definitive Guide for Neutralizing Pet Odors

Table of ContentsNeutralizing Pet Odors Fundamentals ExplainedNeutralizing Pet Odors for DummiesGetting My Neutralizing Pet Odors To WorkThe Best Guide To Neutralizing Pet Odors

/best-home-warranty-companies-4158878_V3-2d7d24f6760f436289b01ea382feca97.png)

Have you ever before wondered what the difference was between a house service warranty and residence insurance? Do you require both a home warranty and also residence insurance policy, or can you get simply one? A house service warranty safeguards a home's interior systems and home appliances.

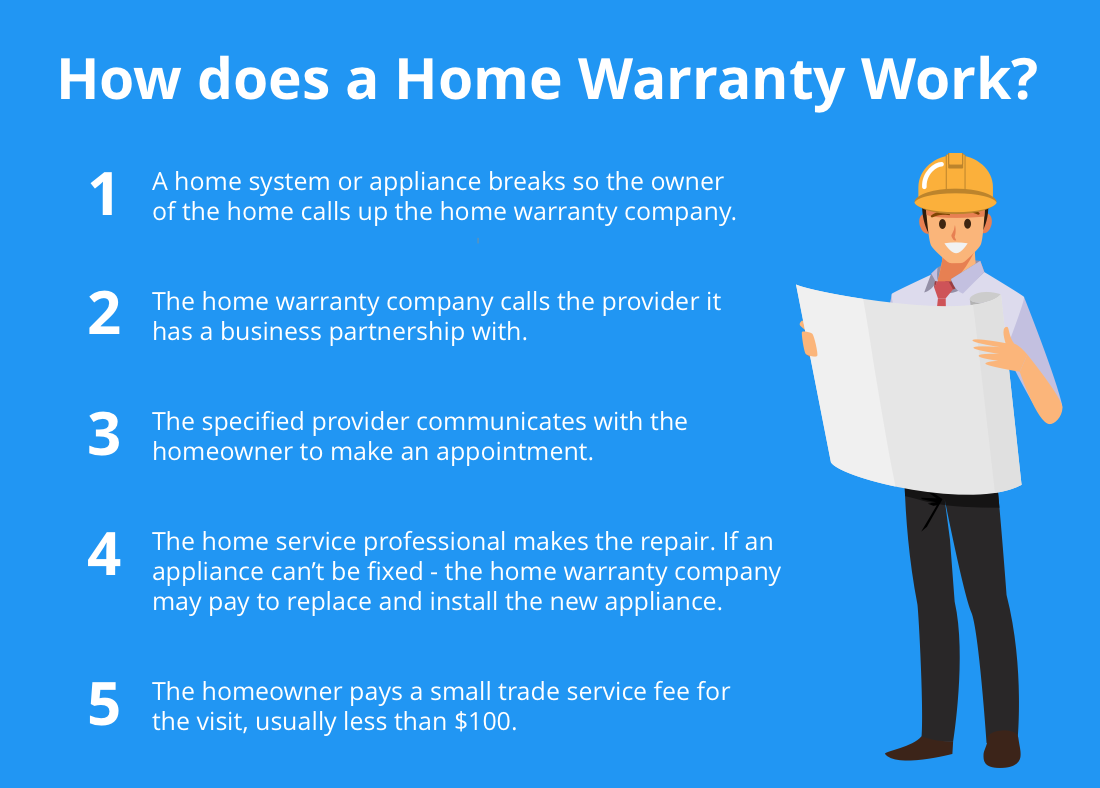

If the system or device is covered under the house owner's house warranty plan, the home warranty firm will certainly send out a professional that specializes in the repair work of that certain system or appliance - neutralizing pet odors. The homeowner pays a flat rate solution call cost (usually in between $60-$100, relying on the residence service warranty company) to have the specialist involved their home and also identify the trouble.

7 Easy Facts About Neutralizing Pet Odors Shown

What does a house service warranty cover? A residence service warranty covers the major systems in a home, such as a house's home heating, air conditioning, plumbing, as well as electric systems. A residence service warranty might likewise cover the larger home appliances in a home like the dishwasher, oven, fridge, garments washing machine, as well as clothes dryer. Home service warranty business usually have various plans offered that provide insurance coverage on all or a select few of these products.

If a toilet was leaking, the residence guarantee firm would pay to deal with the toilet, however would not pay to fix any kind of water damage that was created to the structure of the home since of the leaking commode. Luckily, it would certainly be covered by insurance coverage. What is residence insurance? If a property owner has a home loan on their residence (which most home owners do) they will certainly be called for by their mortgage lender to acquire home insurance policy.

House insurance coverage may additionally cover clinical expenditures for injuries that people sustained by being on your building. A property owner pays an annual premium to their homeowner's insurance provider. Generally, this is somewhere in between $300-$1,000 a year, depending upon the plan. When something is harmed by a catastrophe that is covered under the house insurance plan, a homeowner will call their residence insurance firm to sue.

Neutralizing Pet Odors Can Be Fun For Everyone

What is the Difference Between House Service Warranty and Home Insurance Policy A residence warranty contract as well as a residence insurance plan operate in here similar methods. Both have an annual costs and also a deductible, although a home insurance premium and also insurance deductible is commonly much greater than a home warranty's. The primary distinctions in between residence warranties and home insurance coverage are what they cover.

Another difference between a residence warranty as well as residence insurance coverage is that residence insurance is normally needed for property owners (if they have a mortgage on their home) while a residence service warranty strategy is not needed - neutralizing pet odors. A house warranty and residence insurance supply security on different components of a house, as well as together they can protect a property owner's budget from expensive fixings when they unavoidably turn up.

If there is damage done to the structure of your house, the owner will not have to pay the high costs to fix it if they have house insurance coverage. If the damages to the home's framework or house owner's belongings was caused by a malfunctioning home appliances or systems, a home warranty can help to cover the expensive repair work or substitute if the system or home appliance has fallen short from regular wear as well as tear.

Neutralizing Pet Odors Fundamentals Explained

"Nevertheless, the more systems you add, such as swimming pool insurance coverage or an extra heater, the higher the expense," she claims. Adds Meenan: "Costs are frequently negotiable too." Besides the annual cost, property owners can anticipate to pay typically $100 to $200 per solution call check out, relying on the kind of contract you get, Zwicker notes.

Residence warranties do not cover "products like pre-existing problems, animal invasions, click for info or remembered items, explains Larson. This is the time to take a close check out your coverage since "the exemptions differ from program to program," claims Mennan."If people don't check out or recognize the coverages, they might wind up thinking they have insurance coverage for something they do not."Testimonial coverages and exclusions during the "complimentary appearance" duration.

"We paid $500 to authorize up, and after that needed to pay an additional $300 to cleanse the major sewage system line after a shower drainpipe back-up," states the Sanchezes. With $800 expense, they assumed: "We really did not profit from the house guarantee in any way." As a young couple in another home, the Sanchezes had a challenging experience with a home warranty.

When the specialist wasn't pleased with an analysis he obtained while checking the heating system, they state, the company would certainly not concur to protection unless they paid to replace a $400 part, which they did. While this was the Sanchezes experience years earlier, Brown validated that "evaluating every major appliance prior to supplying coverage is not an you could try here industry criterion."Always ask your company for clarity.